India Telecom: Growth Plateau, Jio & Airtel Diversify to Broadband & 5G

India's telecom growth slows to 11%. Jio & Airtel target broadband (100M homes), FWA, & data centers. Jio leads in 5G/FWA market share. Companies are enhancing investment in technology for future growth.

Telecom Growth Slowdown

India’s telecom sector is hitting a growth plateau after a year of strong gains from tariff boosts, with quarterly profits expansion reducing from an ordinary 15.3% to 11% year-on-year in the second quarter of financial 2026, according to analysts at BNP Paribas and Jefferies.

Jio and Airtel’s Diversification

With mobile service energy regulating, drivers are diversifying. Jio and Airtel are targeting 100 million homes for broadband connectivity and ramping up investments in taken care of cordless gain access to (FWA) and data. Jio has actually scaled its home broadband base to 23 million customers versus Airtel’s 12 million, with Jio’s FWA clients getting to 9.5 million contrasted to Airtel’s 2.3 million.

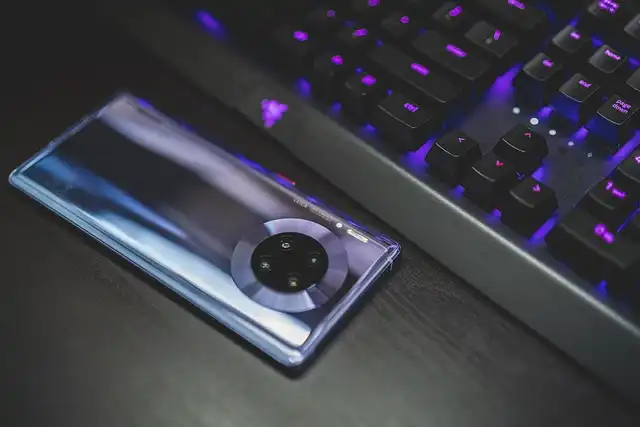

Jio’s 5G Technology

The business has established what the company calls a “extensive 5G technology stack” extending radios, network core systems, and cloud-native operations platforms, examined at scale with over 200 million customers.

The market added around 9 million sim clients in Q2FY26, with Jio capturing 8 million net additions while Vodafone Idea shed 1 million. Consecutive quarterly earnings growth boosted to 2.7% from 2.4%, assisted by an extra day in the quarter and boosting consumer mix as operators press content-bundled strategies and postpaid upgrades.

Market Share and Investment

Jio Platforms has actually magnified technology their financial investments, with patent filings leaping 13-fold and patent gives raising fourfold over the previous 2 years. The firm has additionally increased contributions to 3GPP criteria for 5G/6G by virtually sevenfold to 70.

India’s telecommunications income growth reduced to 11% in Q2FY26 as toll hike advantages wane. Sector leaders Dependence Jio and Bharti Airtel are now focusing on home broadband, data centers, and worldwide tech sales to drive future growth. Operators are additionally pressing costs solutions and content-bundled strategies to enhance earnings until the following rate increase.

“Offered international 5G penetration is reduced, specifically in low-income markets, Jio’s 5G tech pile, which has been examined at a scale of 200m+ subscribers, provides a strong economical option and can drive added layer of development for Jio,” Jefferies experts Akshat Agarwal and Bhaskar Chakraborty wrote in the record.

256 versus Jio’s Rs.211, though both saw healthy and balanced sequential gains according to reports. Jio currently commands 65% of India’s 5G client market and 75% of the FWA market.

Jio and Airtel are targeting 100 million homes for broadband connectivity and ramping up financial investments in dealt with wireless gain access to (FWA) and data. Jio has actually scaled its home broadband base to 23 million clients versus Airtel’s 12 million, with Jio’s FWA customers reaching 9.5 million contrasted to Airtel’s 2.3 million.

Capex Intensity Decreasing

Jio currently regulates 65% of India’s 5G subscriber market and 75% of the FWA market.

Both Jio and Airtel have actually mainly completed their 4G/5G network investments, with capex intensity decreasing. “Airtel and Jio are targeting a potential pool of 100m homes for broadband connection and are tipping up their financial investments,” BNP Paribas wrote. “Airtel has actually additionally enhanced its capex intensity in home broadband to enhance its market share.”

1 5G Technology2 Airtel Africa

3 Broadband Alliance

4 crore on Jio

5 FWA Market

6 India telecom

« IGT Solutions & NiCE: AI-Powered Customer Experience CollaborationTRAI: ‘1600’ Number Series for BFSI to Curb Spam »